Equity Participation

Equity Participation

The purpose of this write-up is to draw attention to an important issue that is being neglected. Misunderstandings are as much a reason for this non-participation as ignorance.

We usually keep the savings in the form of a bank balance after spending from our earnings. Due to inflation, the value of this continues to deplete. Inflation is a reality of the current world that is reducing the value of most of the currencies in the world. The main reason for this is the printing of money irresponsibly by all countries since the Bretton Woods Conference. If the growth rate of money supply (that includes money printing) in an economy exceeds the growth rate of goods and services, the natural consequence will be inflation.

For example, if the current value of a product is one lakh. And if the inflation rate is 7.5%, then after 10 years the product will be priced at Rs 206,103. According to the latest figures from MOSPI, the inflation rate in May was 6.2%. However, the general opinion of economists is that government figures do not reflect real inflation because of tinkering with the methodology. Real inflation is much higher.

Once it’s established that government currency is a depreciating asset, putting once wealth in the form of bank balance is not only against common sense but also against the objectives of Shariah. Protection and preservation of wealth is one of the main objectives of Shariah in the views of Imam Al-Juwaini, Imam Abu Hamid AL-Ghazali, Imam Al-Izz bin Abdul Salam, Imam Abu Ishaq Al-Shatibi and others.

Wealth, like all other things, is a blessing from the Almighty God. As the stewards of God on this earth and trustee of wealth, it is the responsibility of men not to waste it. As Allah (SWT) has said:

إِنَّ الْمُبَذِّرِينَ كَانُوا إِخْوَانَ الشَّيَاطِينِ وَكَانَ الشَّيْطَانُ لِرَبِّهِ كَفُورًا

“Surely the wasteful are ˹like˺ brothers to the devils. And the Devil is ever ungrateful to his Lord.” (17:27)

The divine command related to stealing is also related to the protection of wealth as Allah SWT has said:

وَالسَّارِقُ وَالسَّارِقَةُ فَاقْطَعُوا أَيْدِيَهُمَا جَزَاءً بِمَا كَسَبَا نَكَالًا مِّنَ اللَّهِ ۗ وَاللَّهُ عَزِيزٌ حَكِيمٌ (المایدہ ٢٧)

“As for the thief, both male, and female, cut off their hands. It is the reward of their deeds, an exemplary punishment from Allah. Allah is Mighty, Wise.”

The Illah (reason) for the prohibition of stealing and robbery is that it goes against the Shariah objective of protection and preservation of wealth. In Islamic jurisprudence of Muamlaat, the jurists, especially the Hanafi jurists, have used this objective of Shari'ah as a basis for declaring permissibility of transactions and they declared every transaction in which one's financial rights are violated to be unlawful. It is noteworthy, that the printing of money irresponsibly by the government is a form of theft of public property since it depletes the value of the currency in which most people put their wealth.

The stock market is a way to hedge against this inflation and a preferable alternative over keeping surplus assets in the form of bank balances. This not only guarantees the protection of wealth but also guarantees wealth creation. Both preservation and creation are as per the Shari'ah objectives in light of divine order of:

وَابْتَغُوا مِنْ فَضْلِ اللَّهِ

“and seek of the Bounty of Allah”

Undertaking entrepreneurial activities is preferable in light of several narrations like:

سُئِلَ النَّبِيُّ صَلَّى اللَّهُ عَلَيْهِ وَسَلَّمَ عَنْ أَفْضَلِ الْكَسْبِ فَقَالَ بَيْعٌ مَبْرُورٌ وَعَمَلُ الرَّجُلِ بِيَدِهِ (رواه أحمد)

‘A mabrur trading (business) is according to shari’a and it does not contain trick factors and sins. And a job that is done by someone with his hands.” (Narrated by Ahmad)

The phrase “job that is done by someone with his hands” indicates the gloriousness of indulging in direct economic activity. If a person cannot become an entrepreneur and has surplus money he can supply idle funds to the entrepreneurs who are undertaking investment and productive activities and can participate in the economic growth indirectly.

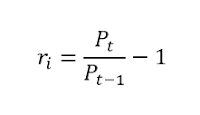

According to the latest figures, only 3.7% of the Indian population participates in the equity market and a large number of account holders are inactive. Indians generally use gold and land as a hedge against inflation. However, historically, the growth rate of the shares has been higher than both.

Financial awareness and education of Muslims can not only result in the preservation of their wealth but also may lead to wealth creation.

Comments

Post a Comment