Should i buy a property/flat on installments?

Suppose, a real estate firm approaches you to pitch for the

sale of its upcoming “tower” apartments. The rates quoted by them for a 3-BHK

is as follows:

Payment

Plan

Plan-A

1140 sqft (126 sq.yards)

Price:

27.50 Lacs

Booking

amount Rs. 7.5 Lacs

S. No.

|

Instalments

|

Amount (Rs)

|

1

|

60 months × 30 thousand

|

1800000

|

2

|

1 Jan 2023

|

100000

|

3

|

1 Feb 2023

|

100000

|

Total

|

2000000

|

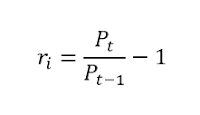

They are repeatedly stressing on the Price: 27.5 Lakhs and peripherals including the park, gym, cafeteria, community hall, prayer hall along with imaginary photos of the future facilities to distract you from the actual price. And of course, the friendly payment schedule. The question one must ask is “is the price of the flat really 27.5 Lakhs?” (the actual money you will pay them including the booking amount of 7.5 lakh, 60 installments of ₹30000 each and two in-betweeners of ₹100000). Or in other words, will that flat cost me 27.5 Lakhs? The answer is a big NO. And that is because of the lost opportunity to earn profits on the amount you would pay the builder.

Suppose you invest the same amount in a mutual fund or in Shariah compliant stocks portfolio in the

same payment schedule. Assuming a rate of 15% return. The initial investment of

₹750000 will turn into ₹ 15,08,517.89 in 5 years. And the monthly SIPs

of ₹30000 for 60 months along with two in-betweeners of ₹ 100000 at the end of the

4th year will compound to ₹ 29,21,168.55. In other words, if you

invest your money in a mutual fund using the same payment schedule as the builder

is asking you will end up will an amount of ₹ 46,29,686.44 or 46.29 Lakhs at the end of 5th

year.

Alternatively, the flat is going to cost you 46.29 Lakhs (which

is approx. 70% more than the quoted price)instead of 27.5 Lakhs quoted by the builder. Now,

if you think that is an appropriate price of the property you may go for it or

alternatively go for aggressive investing.

Thanks Dr. Tariq Aziz for sharing your logical calculations. This will be very useful for new flat buyers and a pinch to builders..

ReplyDeleteThanks for reading

Delete