Simple or Log Returns?

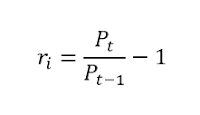

One thing that puzzles many in quantitative finance

is when log return is appropriate and when simple return should be used.

While there are several benefits of using log returns like log-normality,

time additiveness, approximate raw-log equality and mathematical ease, a common

fallacy is to use is at places where it is not appropriate. The most important

difference between simple and log returns is the features of time-additivity

and asset-Additivity.

Simple

returns are asset-additive: Portfolio return is

the weighted average of the stocks in the portfolio.

where weights are the

proportion of an individual stock in the portfolio and the sum of the weights

is 1. Therefore, if an investor puts an equal amount of money in each stock it

will be called “equally-weighted” portfolio. The return of an equally-weighted

portfolio is just the average return of all stocks in the portfolio.

On the contrary, if investment in each stock is in proportion to

its total outstanding market shares it is termed as “value-weighted” portfolio,

where the weight of an asset is equal to

the proportion of its value to the total value of all assets in the portfolio.

A value-weighted portfolio is more realistic and easy to maintain as no

frequent rebalancing is required.

Log

returns are not asset-additive. The weighted average of log returns of

individual stocks is not equal to the

portfolio return. In fact, log returns

are not a linear function of asset weights. In comparison, if simple returns

are used than the portfolio return is the weighted average of assets in that

portfolio. So one of the advantages of

simple return is that it can be used where portfolios are formed and portfolio

returns have to be calculated because of its asset-additive property.

Log

returns are time-additive: The logarithmic return

of an asset over a period of t to T is the sum of all logarithmic returns

between the t and T. In other words, the log return over n

periods is merely the difference in log between initial and final periods. This

is an advantage because the sum of a

normally distributed variable is also normally-distributed.

This is a negative feature of simple returns as probability

theory states that the product of normally distributed variables is not normally-distributed.

Takeaways:

1. When a cross-section of assets is being studied use simple returns

Reference:

1. Campbell, J. Y., Lo, and A. W., MacKinlay (2007). The econometrics of financial markets. PrincetonUniversity Press, Princeton, New Jersey.

Thanks Dr. Tariq Aziz for sharing the article..

ReplyDeleteuseful thank you

ReplyDeletethank u

ReplyDeleteHello, I dont suppose you know the answer to this... if you are using log returns in the capital asset pricing model, does the risk-free rate also need to be in log returns?

ReplyDelete

ReplyDeleteunder what circumstances log returns can be problematic for measuring portfolio performance?

common stock value calculator

ReplyDeleteIDM Crack

ReplyDeletehistorical stock value calculator