Equity Risk Premium in India

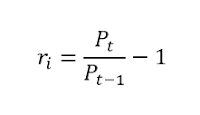

The empirical regularity that stocks provide a

higher return than government bonds is known as “equity premium” puzzle, a term

first coined by Mehra and Prescott (1985). The most intuitive answer that

stocks are riskier than Bonds is not a sufficient explanation for this observed

puzzle. Moreover, this equity risk premium (ERP) epitomizes the investor risk

aversion. A person if given a choice between a low but sure payoff and a high but uncertain payoff would choose the guaranteed payoff if he is risk-averse. Given

the expected utility of both the scenarios are same, a risk-neutral person

would be indifferent between the choices.

However, the presence of equity risk premium (ERP)

exemplifies that investors are largely risk-averse. Because arbitrage by investors

should have eliminated (or reduced) the return difference between these two

investment opportunities which is not the case in the present case.

Table-Equity Risk Premium in India 2000-2016

Year

|

BSE500

|

Yield

on 10 Year Govt. Bond

|

Premium

|

2000

|

-27.17%

|

11.04%

|

-38.22%

|

2001

|

-22.91%

|

9.37%

|

-32.28%

|

2002

|

16.99%

|

7.20%

|

9.80%

|

2003

|

101.10%

|

5.60%

|

95.49%

|

2004

|

17.47%

|

5.93%

|

11.53%

|

2005

|

36.56%

|

6.97%

|

29.59%

|

2006

|

38.85%

|

7.66%

|

31.19%

|

2007

|

63.02%

|

7.95%

|

55.07%

|

2008

|

-58.14%

|

7.85%

|

-65.99%

|

2009

|

90.23%

|

6.95%

|

83.28%

|

2010

|

16.35%

|

7.85%

|

8.50%

|

2011

|

-27.41%

|

8.37%

|

-35.78%

|

2012

|

31.20%

|

8.30%

|

22.90%

|

2013

|

3.25%

|

8.20%

|

-4.95%

|

2014

|

36.96%

|

8.56%

|

28.40%

|

2015

|

-0.82%

|

7.75%

|

-8.57%

|

2016

|

3.78%

|

7.18%

|

-3.39%

|

Mean

|

18.78%

|

7.81%

|

10.98%

|

This table shows annual returns of S&P BSE 500

index during 2000-2016 and the average

yield on 10-year government bond obtained from Investing.com. 10 out of last 17

years have provided a positive equity premium. On the other hand, the equity premium is

negative in rest of the 7 years. However, on an average, the risk premium is

10.98% during the sample period. I would like to add a caveat here that it is

very easy to fall victim to the fallacy of average, as the standard deviation

of the ERP is 42.4%, which is quite high.

As Nassim Nicholas Taleb puts it very eloquently: "Don't cross a river if it is four feet deep on average". Although the ERP is 10.98% on average during the last 17 years, there is a lot of volatility in it. For example. in 2008 (which is the period of the financial crisis), the ERP is -65% or an investor who was expecting a return of 10.98% above the risk-free rate may have ended up eroding his investment by 65%. Or take the example of the latest two years. Both in 2015 and 2016 the ERP is negative. Therefore, investors would have been better off if they would have invested in Govt. Bonds instead of equity market in these two years. But again this statement is true only ON AVERAGE.

As Nassim Nicholas Taleb puts it very eloquently: "Don't cross a river if it is four feet deep on average". Although the ERP is 10.98% on average during the last 17 years, there is a lot of volatility in it. For example. in 2008 (which is the period of the financial crisis), the ERP is -65% or an investor who was expecting a return of 10.98% above the risk-free rate may have ended up eroding his investment by 65%. Or take the example of the latest two years. Both in 2015 and 2016 the ERP is negative. Therefore, investors would have been better off if they would have invested in Govt. Bonds instead of equity market in these two years. But again this statement is true only ON AVERAGE.

Thanks

ReplyDelete