Simple or Log Returns?

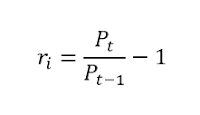

One thing that puzzles many in quantitative finance is when log return is appropriate and when simple return should be used. Simple Return Formula: Log Return Formula: While there are several benefits of using log returns like log-normality, time additiveness, approximate raw-log equality and mathematical ease, a common fallacy is to use is at places where it is not appropriate. The most important difference between simple and log returns is the features of time-additivity and asset-Additivity. Simple returns are asset-additive : Portfolio return is the weighted average of the stocks in the portfolio. where weights are the proportion of an individual stock in the portfolio and the sum of the weights is 1. Therefore, if...